Global Markets Poised for Expansion, Says Goldman Sachs, Citing AI and Green Tech

Artificial intelligence and decarbonization are driving the world economy into a new "super cycle," according to Peter Oppenheimer, Head of Macro Research at Goldman Sachs in Europe. During an appearance on CNBC's "Squawk Box Europe" on Monday, he stressed the evident shift towards this revolutionary stage of the economy.

Super cycles are characterized by protracted periods of economic prosperity that are frequently accompanied by rising GDP, robust demand for commodities that drives up prices, and high employment.

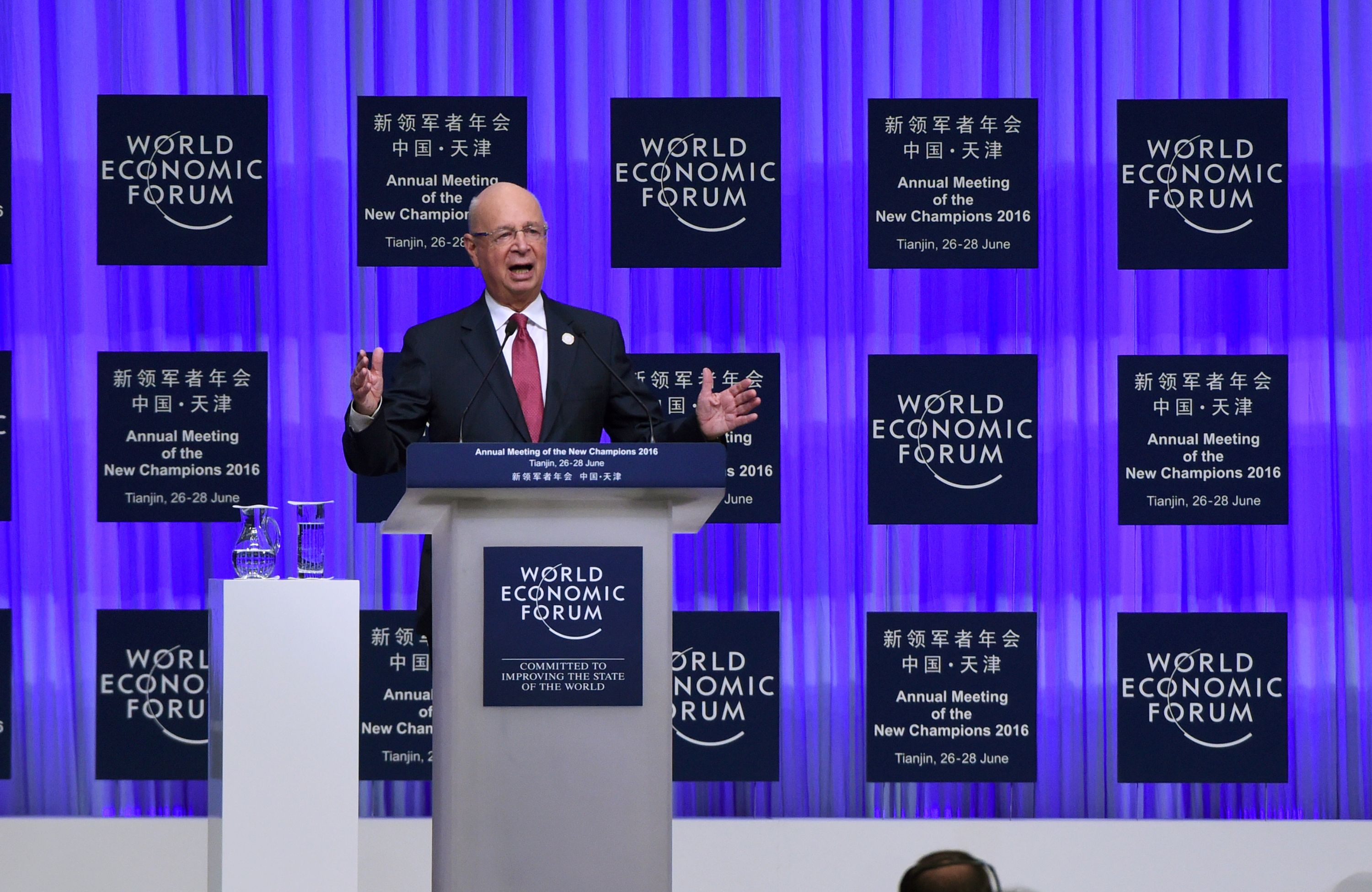

(Photo : by Spencer Platt/Getty Images)

Artificial intelligence and decarbonization are driving the world economy into a new "super cycle," according to Peter Oppenheimer, Head of Macro Research at Goldman Sachs in Europe. During an appearance on CNBC's "Squawk Box Europe" on Monday, he stressed the evident shift towards this revolutionary stage of the economy.

In a discussion of material from his recently released book "Any Happy Returns," Oppenheimer stated that the world economy went through its most recent substantial super cycle in the early 1980s.

He clarified that this was marked by a high in interest rates and inflation, followed by decades of declining capital costs, rates, and inflation, along with economic reforms like deregulation and privatization. Meanwhile, geopolitical risks eased and globalization grew stronger, Oppenheimer noted.

Oppenheimer did point out that not all of these elements are anticipated to last in the same way. He emphasized that during the next ten years, it is unlikely that interest rates will continue their sharp decline. In addition, there is opposition to globalization, and geopolitical tensions are rising.

Read Also: Fed Pivot Calms Junk Bond Jitters, But Concerns Remain Over Debt Sustainability

Geopolitical Challenges and Economic Trends

Markets have been concerned about a number of geopolitical issues in recent months and years, including the Israel-Hamas conflict that is causing ripple effects throughout the Middle East, the Russia-Ukraine war, and trade-related tensions between the United States and China.

The speed of financial returns should, in theory, slow down due to present economic trends, but Oppenheimer pointed out that decarbonization and artificial intelligence may have a favorable effect.

Artificial intelligence (AI) is still in its infancy, according to Oppenheimer. Nonetheless, AI may benefit stocks as it gets more and more integrated into new goods and services. It is anticipated that the continuous debates about productivity and AI, which are frequently accompanied by worries about job transformation or displacement, would have an impact on the economy.

Oppenheimer further underlined that increased productivity is expected as a result of AI applications, which may have a favorable impact on profit margins and economic development.

Oppenheimer noted that although decarbonization and artificial intelligence are both relatively new ideas, there are historical similarities.

He said that the early 1970s and early 1980s were "not so dissimilar" to present trends, making them one of the historical eras that stands out. He stated that higher interest rates and inflation were maybe more fundamental problems in the past than they are now, but other elements-such as escalating geopolitical tensions, increased taxes, and greater regulation-appears to be comparable.

According to Oppenheimer, there are further ways in which the current changes might be understood as a reflection of historical developments.

The expected "tremendous twin shock" of rapid technology advancement and economic upheaval in the direction of decarbonization was emphasized by Oppenheimer. He compared the forthcoming era to the late 1800s, when significant gains in productivity were achieved along with urbanization, industrialization, and the construction of infrastructure.

Oppenheimer stressed that these historical connections might teach us important lessons for the future, arguing that we can learn how to manage and navigate the revolutionary changes in the economy that are about to occur from the lessons learned in the late 19th century.

Related Article: Wall Street Cheers as Bitcoin Breaks the Chains, Soars Above $45,000 in New Year's Rally